All of the following are for agi deductions except – Navigating the complexities of the tax code, understanding the distinctions between various deductions is paramount. This discourse delves into the realm of AGI deductions, exploring those that qualify and excluding those that do not, shedding light on the nuances that shape tax liability.

The Internal Revenue Service (IRS) defines AGI (Adjusted Gross Income) as the amount of income subject to taxation after subtracting certain allowable deductions. These deductions reduce taxable income, thereby lowering tax liability. However, not all deductions fall under the AGI category.

This discussion will identify and explain the specific deductions that are excluded from AGI calculations.

AGI Deductions

Adjusted gross income (AGI) is the amount of income that is subject to taxation. AGI deductions are expenses that can be subtracted from gross income to arrive at AGI. These deductions reduce the amount of income that is subject to taxation, thereby lowering the taxpayer’s tax liability.

Identify the Deductions

- Medical expenses that exceed 7.5% of AGI

- State and local income taxes

- Real estate taxes

- Personal property taxes

- Mortgage interest

- Student loan interest

- Alimony

- Gambling losses (up to the amount of winnings)

- Certain retirement plan contributions

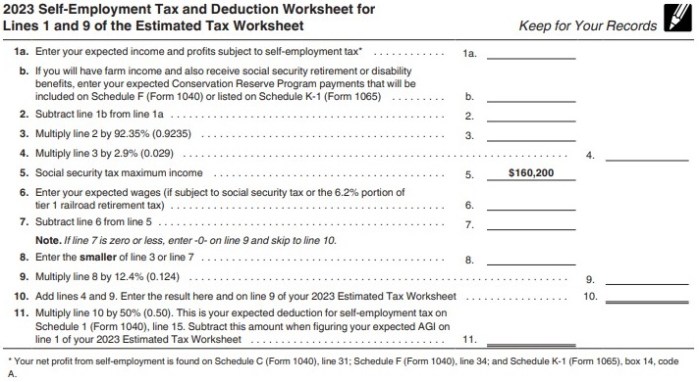

- Self-employment health insurance premiums

Explain the Exclusions

Certain expenses are not deductible from AGI. These expenses include:

- Federal income taxes

- Social Security taxes

- Medicare taxes

- Personal expenses

- Capital expenses

- Expenses related to tax-exempt income

These expenses are not deductible from AGI because they are either not considered to be expenses incurred in the production of income or because they are specifically excluded by law.

Provide Examples

| AGI Deduction | Description | Non-AGI Deduction | Description |

|---|---|---|---|

| Medical expenses | Expenses incurred for the diagnosis, treatment, or prevention of disease | Personal expenses | Expenses incurred for personal comfort or convenience |

| State and local income taxes | Taxes paid to state and local governments | Federal income taxes | Taxes paid to the federal government |

| Mortgage interest | Interest paid on a mortgage secured by a principal residence | Capital expenses | Expenses incurred to improve or maintain property |

| Student loan interest | Interest paid on student loans | Expenses related to tax-exempt income | Expenses incurred to generate income that is not subject to taxation |

Discuss Implications: All Of The Following Are For Agi Deductions Except

Excluding certain expenses from AGI deductions can have a significant impact on taxpayers. By reducing the amount of income that is subject to taxation, AGI deductions lower the taxpayer’s tax liability. Excluding certain expenses from AGI deductions can increase the taxpayer’s tax liability.

In addition, excluding certain expenses from AGI deductions can distort the tax system. By allowing some expenses to be deducted from AGI while disallowing others, the tax system can create incentives for taxpayers to engage in certain behaviors. For example, the deduction for mortgage interest encourages taxpayers to purchase homes, while the disallowance of the deduction for personal expenses discourages taxpayers from spending money on non-essential items.

Key Questions Answered

What is the difference between AGI and non-AGI deductions?

AGI deductions directly reduce taxable income, while non-AGI deductions reduce the amount of income subject to certain taxes, such as self-employment tax.

Can I claim a deduction for my personal expenses?

No, personal expenses are not deductible from AGI.

What are some examples of non-AGI deductions?

Non-AGI deductions include student loan interest, contributions to traditional IRAs, and health savings account contributions.